CCI

Source

Syntax Format

cci(series, period)

Overview

CCI (Commodity Channel Index) is an oscillator, which uses the corridor of set frames, within which an average price function moves. The breaking points of the moving average over the set levels can identify potential trend reversals, as well as overbought and oversold states of an asset.

Parameters

| Parameter | Type | Purpose |

|---|---|---|

| series | series | Input data, taken into calculation |

| period | integer | Input period, taken into calculation |

Returns: series.

Example

instrument { name = "Commodity Channel Index", icon = "indicators:CCI" }

input_group {

"Commodity Channel Index",

period = input (20, "period", input.double, 1),

color = input { default = "#FBE90C", type = input.color },

width = input { default = 1, type = input.line_width}

}

input_group {

"Support Lines",

overbought = input (100, "overbought", input.double, -200, 200, 1, false),

oversold = input (-100, "oversold", input.double, -200, 200, 1, false),

overbought_color = input { default = rgba(37,225,84,0.50), type = input.color },

oversold_color = input { default = rgba(255,108,88,0.50), type = input.color },

bg_color = input { default = rgba(255,255,255,0.05), type = input.color },

support_width = input { default = 1, type = input.line_width}

}

nom = hlc3 - sma (hlc3, period)

denom = mad (hlc3, period) * 0.015

res = nom / denom

fill_area (overbought, oversold, "", bg_color)

plot (res, "CCI", color, width)

hline { value = overbought, color = overbought_color, width = support_width, style = style.dash_line }

hline { value = oversold, color = oversold_color, width = support_width, style = style.dash_line }

hline { value = 120, color = rgba(255,255,255,0.2), show_label = false }

hline { value = -120, color = rgba(255,255,255,0.2), show_label = false }

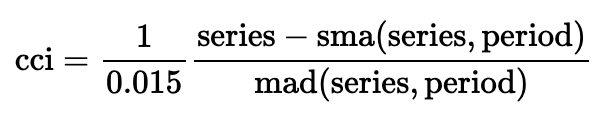

Formula

The formula for calculating CCI is:

The indicator takes the difference between the asset price and the average value of it, dividing by the Mean Absolute Deviation of the price value. The 1/0.015 ratio makes sure that the at least 70% of the indicator's value would be within -100 and +100 range.